What is a fork in Blockchain?

As you may know, a blockchain’s rules are hardcoded from the beginning and cannot be changed unless most users agree. These rules are known as the blockchain’s protocol. The developers determine this protocol, and a blockchain continues its work based on its protocol till the end.

By the way, what happens if some rules prove inefficient over time? Or what happens if a security breach is found in a blockchain protocol? Is this blockchain doomed to the initial protocol, and aren’t there any ways to edit it? And finally, the good news is that a solution exists, which also answers our central question: What is a Fork in Blockchain?

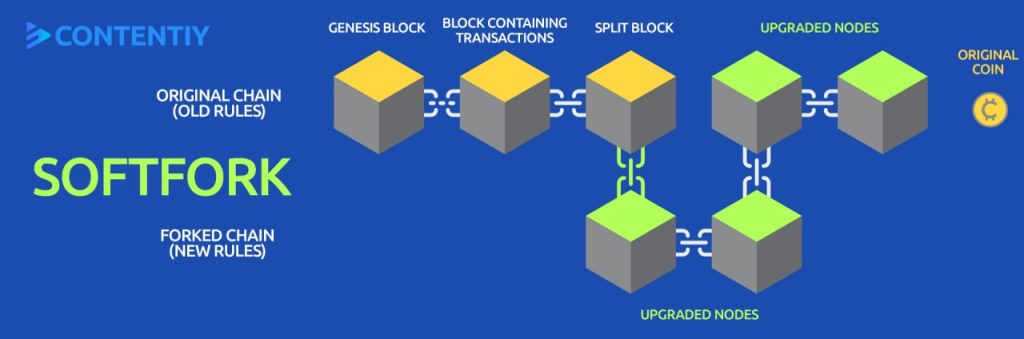

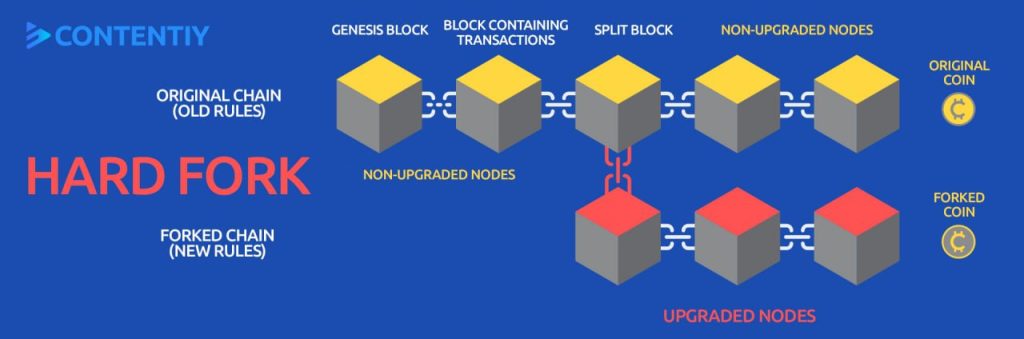

A fork is a solution to the problem we referred to above. A fork usually happens when most blockchain users disagree with its rules. A fork in the crypto world has two types. It is either backward-compatible or backward-incompatible. The first type is called a soft fork, and the second is called a hard fork. Stay with us in the next part to determine what hard and soft forks are and how they are differentiated.

What is a soft fork in Blockchain?

As we answered the question of what a fork is, we also must explain that a soft fork is backward-compatible. A soft fork is an update to the software. The updated version of the blockchain is then compatible with the older version. All blockchain users can receive new blocks using the forked or older versions.

If this definition seems confusing to you, don’t be worried. We can clarify it using an example. Imagine a blockchain has had a soft fork to increase its block size from 1 MB to 2 MB. Nodes without updating their software can still see the new blocks or participate in the validation process.

However, the problem is that they can’t record their 1MB blocks on the network anymore. This is because most nodes don’t recognize 1MB blocks. As a result, the blocks these nodes create are disregarded and finally removed from the network.

Now that we’ve noticed what a fork and soft work is, the next question would be about the latter fork; I mean the hard fork. The main difference between a soft fork and a hard fork is that a soft fork doesn’t lead to a new blockchain. A soft fork is an update to the software that gradually incentivizes all users to follow this update by limiting their functionalities.

What is a hard fork in Blockchain?

A hard fork is a software update incompatible with the previous software version. A hard fork leads to an entirely new blockchain. It divides the blockchain into two different separate chains. One chain is the one that has existed from the beginning, and one chain is the one created recently.

A hard fork is either planned or a response to a challenge that has occurred. The first situation may happen due to technical or conceptual conflicts among blockchain users. In the second situation, it may happen to compensate for users’ losses. Bitcoin Cash is an example of the first situation, and Ethereum’s fork is an example of the second. We will go through each of them separately in the next part.

Some famous examples of forks in the world of blockchains

Forks may be very common among different blockchains and cryptocurrency networks. However, some of them have become more popular than others. We have selected the three most famous forks and will explain why they happened since we answer what a fork is in Blockchain.

Bitcoin SegWit: Soft fork

Bitcoin SegWit is a well-known soft fork that happened in 2017. SegWit stands for Segregated Witness. SegWit was an update to increase Bitcoin’s block size. It changed Bitcoin’s transaction format, removing the witness information from the input field. This way, each Bitcoin block had more free space and could contain more transactions. Bitcoin’s block size increased to 2 to 4 megabytes after SegWit as a result of the fork on the blockchain. Most Bitcoin users and miners now adopt SegWit.

Ethereum and Ethereum Classic: Hard fork

Ethereum was a hard fork that happened in 2016 and is the most famous example of an unplanned hard fork. At that time, a decentralized autonomous organization or DAO known as The DAO worked on Ethereum. The DAO was Ethereum’s most important project, and it had gathered $150 million worth of Ether through its token sale.

The DAO was hacked, and all funds were stolen. Though this hack happened due to a breach in The DAO’s code and had nothing to do with Ethereum, it harmed Ethereum’s reputation. Ethereum went through a hard fork to compensate for the losses and regain its reputation. An exciting feature of hard forks, or, more precisely, all forks- is that after it happens, the same number of tokens on the main chain is created on the new chain.

By the way, not all Ethereum users agreed with this hard fork. As a result, the main chain continued its work under Ethereum Classic. The Ethereum we know today is the new chain created after the hard fork.

Bitcoin Cash: hard fork

The Bitcoin Cash hard fork was another famous hard fork in 2017. It was a response to Bitcoin’s ever-existing scalability challenge. Bitcoin’s block size was 1 MB from the beginning. This is while Bitcoin’s popularity grew so fast that its network couldn’t handle the high demand.

Bitcoin can process all transactions completely and flawlessly, but it takes some time. A Bitcoin transaction usually takes between 10 to 60 minutes. Some Bitcoin users believed this was too slow. They thought that if Bitcoin wanted to compete with centralized payment systems like Visa, it had to do something about this problem.

Bitcoin Cash was a hard fork that increased Bitcoin’s block size to 8 megabytes. Bitcoin Cash is now able to process around 116 transactions per second. This is while Bitcoin can only process 6 to 7 transactions per second.

We should note that while Bitcoin Cash has a higher level of scalability, it hasn’t succeeded in replacing Bitcoin in terms of popularity. Bitcoin is still the largest cryptocurrency by market cap, while Bitcoin Cash is the thirtieth largest. This can be proof of Bitcoin’s high status and strong position among its fans and users and a wise signal that a fork will not end in the desired result.

Conclusion

Forks are valuable updates of cryptocurrencies, and we should be well-informed about the vast answer to what a fork is in Blockchain. This solution solves unpredicted errors, settles disputes, or updates with minor changes. Indeed, forks sometimes lead to divisions or the creation of new chains, but they are generally needed. So, let us ask you again; what is a fork in Blockchain, and what other famous forks do you know?

What is a fork in blockchain?

A fork is a split or divergence in a blockchain network that results in multiple versions of the blockchain operating simultaneously.

Why do forks happen in blockchain networks?

Forks can happen for a variety of reasons, such as disagreements among network participants over proposed changes to the protocol, security vulnerabilities, or changes in governance.

What are the different types of forks in blockchain?

There are two primary types of forks in the blockchain: hard forks and soft forks. Hard forks result in a permanent split in the blockchain network, while soft forks introduce new rules and features without creating a separate chain.