What are stablecoins?

Stablecoins, as their name suggests, are cryptocurrencies or coins with a stable price. You know that price volatility is an intrinsic feature of cryptocurrencies. Stablecoins don’t follow the other cryptocurrencies in this regard.

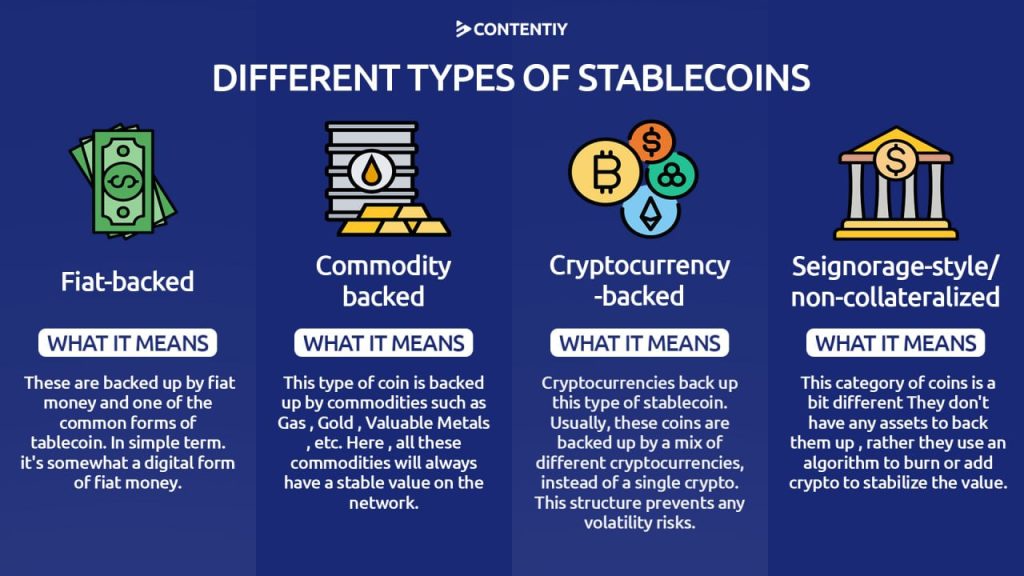

Stablecoins use different methods for keeping their price stable. We don’t go through all these methods (since it’s beyond the scope of this article), but you can have an overview of different types of stablecoins in the image below.

The most common method is pegging the price of the stablecoin to an asset with a stable price. This asset may be the national currency of a country or other valuable assets like gold. For example, a stablecoin like Tether is pegged to the US dollar. Therefore, the price of each unit of Tether is always equal to 1 dollar.

Stablecoins play a crucial role in the cryptocurrency world. They shield your digital assets against price fluctuations during difficult times. Suppose your bitcoin holdings or other cryptocurrencies decrease in value due to unfavorable news or other factors. In that case, you can convert your digital assets to stablecoins within your account to avoid the need to change them to fiat currencies and then back to cryptocurrencies. This conversion process is more affordable and less complicated, thanks to stablecoins.

What is Tether, and how does it work?

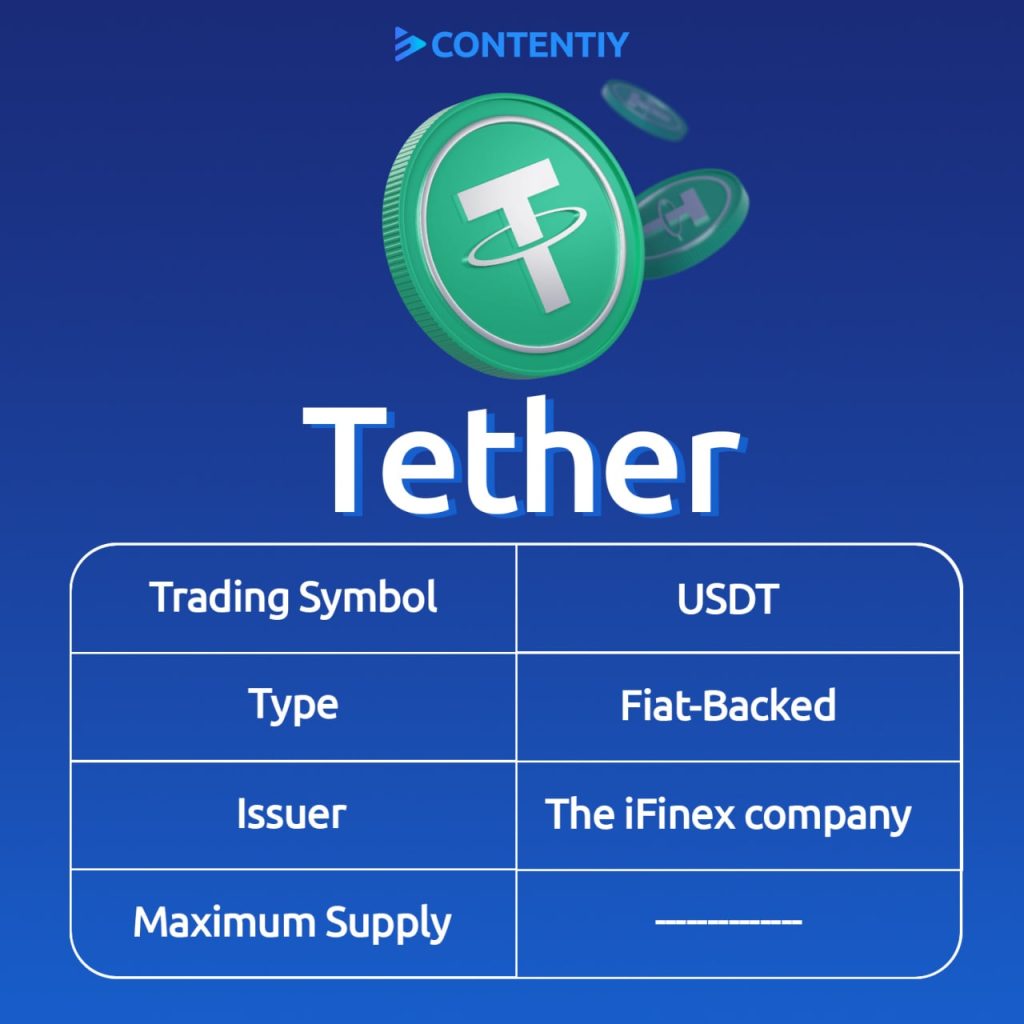

Tether is a stablecoin whose price is pegged to the US dollar. So, the price of each unit of Tether is always equal to $1. Tether is not the only US-dollar-pegged stablecoin, but it is the oldest and the strongest one. Tether was developed and is backed by the iFinex company. iFinex is the developer of the Bitfinex exchange. New units of USDT are issued by iFinex and given to Bitfinex. This exchange then distributes them.

Unlike many cryptocurrencies, Tether does not have a maximum supply. The iFinex company can issue new units of USDT whenever it wants, based on the available demand. However, the point is that in return for each unit of Tether they issue, they have to reserve 1 dollar in bank accounts in the US. There is much dispute regarding the fiat reserves of Tether. Many believe that Tether is not completely backed and doesn’t follow a 1:1 ratio between its issued tokens and its dollar reserves.

What blockchain does Tether use?

Tether was first developed on the Omni layer of the Bitcoin blockchain, but it later expanded to other blockchains like Ethereum, Tron, Bitcoin Cash, and Algorand. This means that Tether has a higher level of accessibility now, and it can be stored on wallets supporting all these blockchains.

Tether (USDT) wallets

As we mentioned in the previous part, Tether works on numerous blockchains. Therefore, there are many options you can choose among (based on the network you choose). Some of the best wallets you can use to store USDT include:

- Ledger (hardware)

- Trezor (hardware)

- Trust Wallet (software – download)

- Coinomi (software – download)

- MyEtherWallet (software – download)

Conclusion

In this article, we tried to explain Tether and its uses. Now you know that Tether is a dollar-backed stablecoin, so its price is always stable at $1. You can buy Tether using cryptocurrency exchanges like all other cryptocurrencies. Tether is the third-largest cryptocurrency by market cap at the time of writing. Therefore, all cryptocurrency exchanges support it. Have you ever used Tether in your trades/investments? Do you prefer any other stablecoin over Tether? Please share your opinions with us.

What is Tether?

Tether is a stablecoin that is designed to maintain a stable value relative to a real-world asset, like the US dollar.

How does Tether work?

Tether works by pegging its value to a fiat currency, such as the US dollar, at a 1:1 ratio. This means that for every Tether coin in circulation, there is an equivalent amount of US dollars held in reserve.

What is the difference between Tether and other cryptocurrencies like Bitcoin and Ethereum?

The key difference between Tether and other cryptocurrencies is that Tether is a stablecoin, while Bitcoin and Ethereum are not. Tether is designed to maintain a stable value relative to a real-world asset, while the value of Bitcoin and Ethereum can be highly volatile.